Our Spectrum Solution

A Wealth Management System

Spectrum eAdvisor

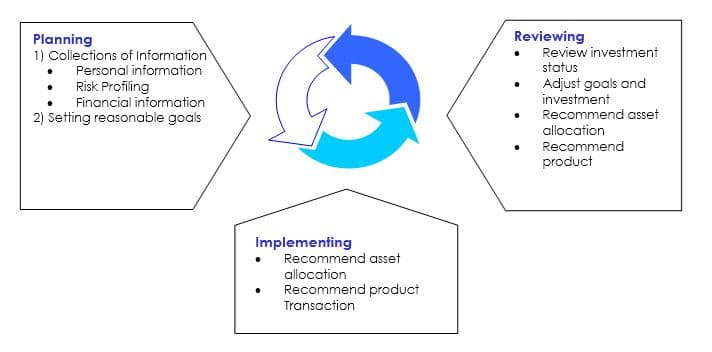

Spectrum eAdvisor is an integrated web-based financial planning solution that is specially designed and developed to assist financial planners in the planning, implementing and monitoring of the financial planning cycle. It is an ideal front-end solution for distributing proprietary and third party financial products and enables a range of financial products to be represented and mapped to the client’s investment strategy / risk tolerance level.

Spectrum eAdvisor offers a broad range of modular financial planning solutions and financial tools that are user-friendly and can be deployed over the internet/intranet. The typical deployment model also offers support for a mobile deployment to the respective advisors local notebook with server synchronisation functionality included to allow data synchronisation and integrity to be maintained.

Financial Planning Cycle

This solution is specially designed to support financial planning services with modules that include:

- Financial Toolkit

- Financial Planner

- Contact Management

- Prospect Management

- Client Enquiry

- Investment Analysis

Our Spectrum eAdvisor system comes in three versions to cater for our customer different target segments being

- a simplified version,

- comprehensive version &

- mobile sales version

Spectrum eManager

Spectrum eManager is a fully integrated web-based solution for the distribution channels in the financial industry. The solution is designed to assist independent financial product’s distributors from the selling process, transaction capture, to administration and management of their operations as well as calculation of various incentives for their agents. The solution provides a seamless integration from the front-office to back-office functions. Support dual languages, multi currency & automated daily price feed upload via third party providers. Any investment products offered under Spectrum eManager framework can share the same client base.

The standard modules offered within Spectrum eManager are:

- System Security

- Customer Information System

- Customer Dashboard – Customers’ Overview Portfolio Holdings

- Registration

- Funds Administration

- Client Delivery

- Standard & Customised Reports

- Statement Printing – The system can split into different investments statement across all investment accounts or can be consolidated as one.

Investment Products currently being offered within Spectrum eManager are:

- Unit Trust – support both conventional & Shariah Enables user to view Portfolio Tracking, Average Cost & Mark to Market valuation. Standing Instruction is available for both Regular saver and Regular withdrawal.

- Bonds – most common types of bonds include government & retail issued bonds for the primary & secondary market. System handles back office functionality such as pricing, booking with provider (treasury), including lodging of bulk orders, early bird interest calculations, maturity redemptions and generating coupon payout.

- Dual Currency Investment (DCI) – supports based trading on determined currency pairs, FX calculations and determination of payout currency based on strike rate / spot rate. User can select the product, currency pairs and settlement details while the System will calculate the payout amount, accrued interest, penalty fee, and handle settlement account selection.

- Equity Linked Notes (ELN) – supports two approaches: Discounted Pricing Approach & Coupon Approach. The system account portfolio view permits user to view specific client holdings on an account level basis as well as Notes level.

- Bancassurance – providing and distributing our customer’s insurance products while tracking and maintaining our customer client base’s insurance holdings. Also integrates with our customer’s multiple insurance partners back end system for update and to monitor policy status.

Spectrum eGuardian

Bancassurance encompasses terms such as ‘Allfinanz’, ‘Integrated Financial Services’ and ‘Assurebanking’ and can be broadly summarised as the offering of both banking and insurance products by the financial entity (i.e. Bank/Insurance Company) and its respective partners (Insurers/ Banks) thus providing an integrated alliance exchanging services or an integrated operational mode.

Xen Solutions’ Bancassurance product Spectrum eGuardian is a comprehensive Bancassurance backend solution that provides end to end processing, starting from the time of proposal creation and submission, to post underwriting process client servicing and bank commission tracking. The solution is designed with the following key considerations in mind, retaining the client ownership within the bank, eradicating duplication and exploiting the cost synergies of integrating banking and insurance operations.

The application can empower the Bank in its quest to overcome the two greatest challenges facing Bancassurance today:

- To persuade customers to commit to regular savings plans (where most banks have traditionally faced difficulties)

- To provide advice and sell more complex products, especially pensions, and particularly to more affluent customers.

In addition Xen’s Spectrum eGuardian helps the Bank realise the need for explicit distinction between its prospective Bancassurance customer segments of which there are at least three main categories:

- The traditional ‘mass market’ Bancassurance

- Private Bancassurance (aimed at wealthy individuals)

- Corporate Bancassurance and SMEs (small to medium-sized enterprises) to reach their employees

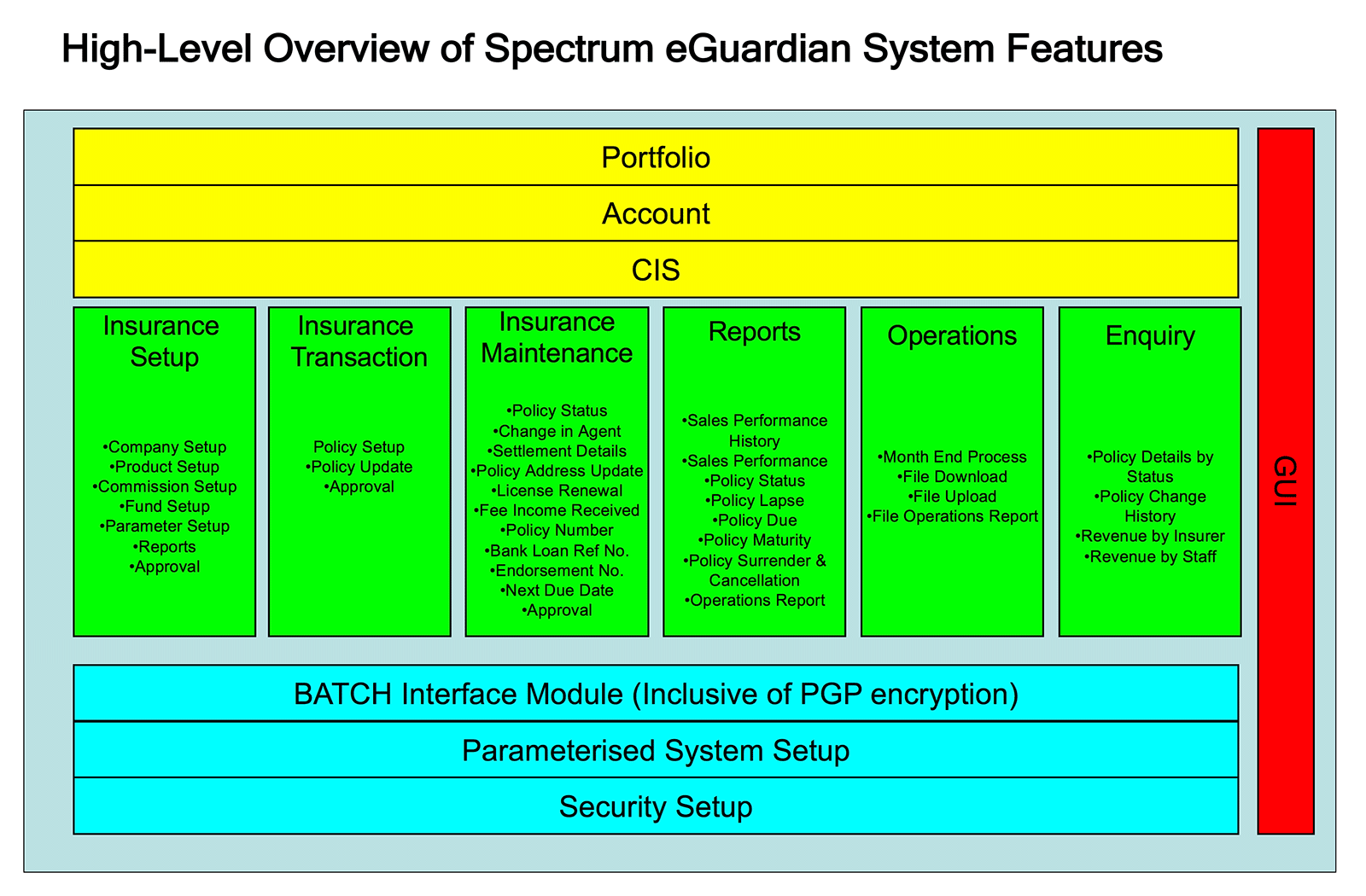

The principle document outlines the key feature of the Spectrum eGuardian solution, which can be run independently or combined with Xen’s Unit Trust IUTA Nominee System (eManager), to incorporate Bancassurance products and the associated back office processing functions required for tracking and maintaining the banks client base’s insurance holdings.

The running of the banks Bancassurance operations includes the following features and functions either in conjunction with Xen’s eManager Unit Trust system or as an independent self contained system: –

| Module Name | Main Functions Performed |

|---|---|

| Customer Information System | Maintains customer profiles. Manages account functions and account structures for customers. |

| Product Registration | Provides flexible features allowing multiple insurance partners and product types to be setup for distribution. Supports both life and general insurance product types. |

| Policy Administration | Provides end-to-end policy administration to support efficient Bancassurance operations including policy creation, underwriting status tracking, premium and commission payment history as well as subsequent policy amendment. |

| Commission and Product Promotion | Flexible structure to support multiple commission and promotion formulas, enabling comprehensive commission tracking for the bank. |

| Interface | Encrypted secure interfaces with insurance partners to facilitate automatic exchange of up-to-date underwriting and policy information. |

| Compliance and Channel Management | Insurance License and agency registration tracking for sales force. |

The broad feature set can be further illustrated by the diagram below: –